self employment tax deferral turbotax

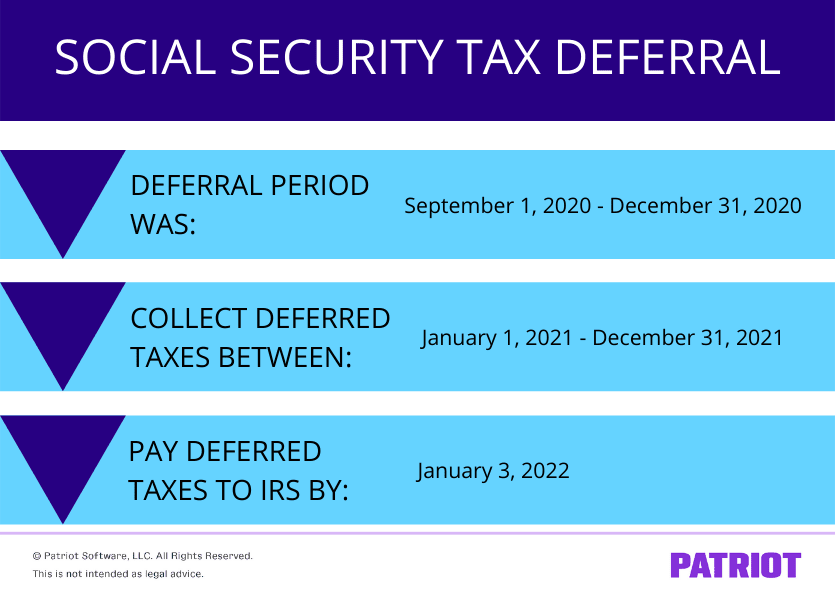

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code. That is correct pitman44 Employers can make the deferral payments through the Electronic Federal Tax Payment.

What The Self Employed Tax Deferral Means Taxact Blog

Line 18 is for the total.

. You can delete your election to defer your self-employment taxes from your tax return. COVID Tax Tip 2021-96 July 6 2021. However the credit you may be seeing is half of your self-employment tax that is.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior. However when you are filling out your 1040 the IRS allows you to deduct a portion of the self-employment tax payments you make as an adjustment to income. How a payroll tax relief deferral may help self-employed people In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self.

After it is paid should an entry be made into TurboTax 2021 as an estimated tax entry for the. Deferral Of Self Employment Tax Turbotax. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment. According to the maximum deferral of self-employment tax payments that TurboTax supports the SE-T is a self-employment taxpayer form. Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete.

If filed after March 31 2022 you will be charged the then-current list price for TurboTax Live Basic and state tax filing requires an additional fee. See current prices here. How do I pay the deferred self-employment tax.

Tax Return Access. If the 2020 tax return had a self employment tax deferral amount to be paid later.

How To Fill Out Your Tax Return Like A Pro The New York Times

Tax Reform How Physicians And The Self Employed Are Affected Physician On Fire

Solved Deferred Social Security Taxes

2021 Instructions For Schedule H 2021 Internal Revenue Service

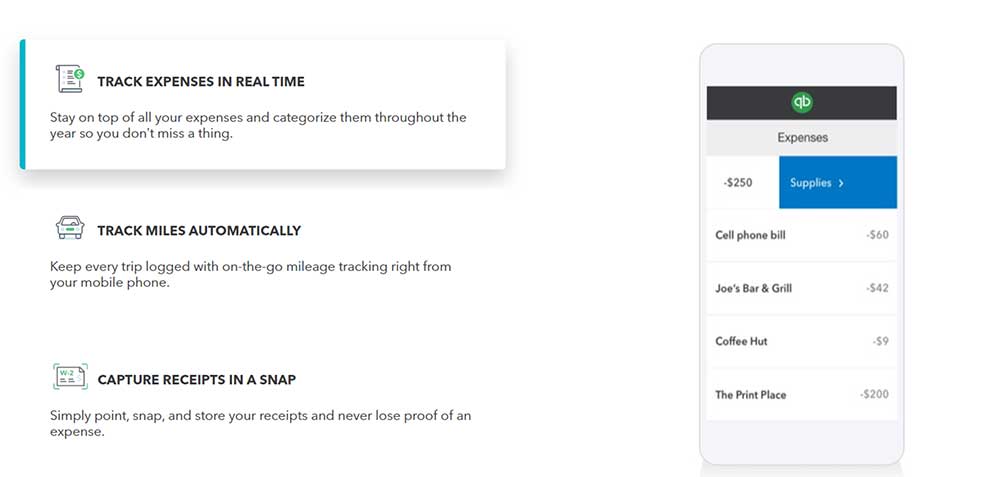

Self Employed Tax Software Calculator Quickbooks

Mrsc W 2 Reporting For Ffcra Wages And Social Security Tax Deferrals

Deferral Of Se Tax Page 2 Intuit Accountants Community

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Self Employment Taxes Archives The Pastor S Wallet

How To File Taxes As A Blogger With Free Turbotax Self Employed Giveaway

Hello Everyone I M Filing My Taxes For 2020 With Turbotax And They Are Asking Me To Check This Entry I Don T Really Understand What I Should Put Here R Tax

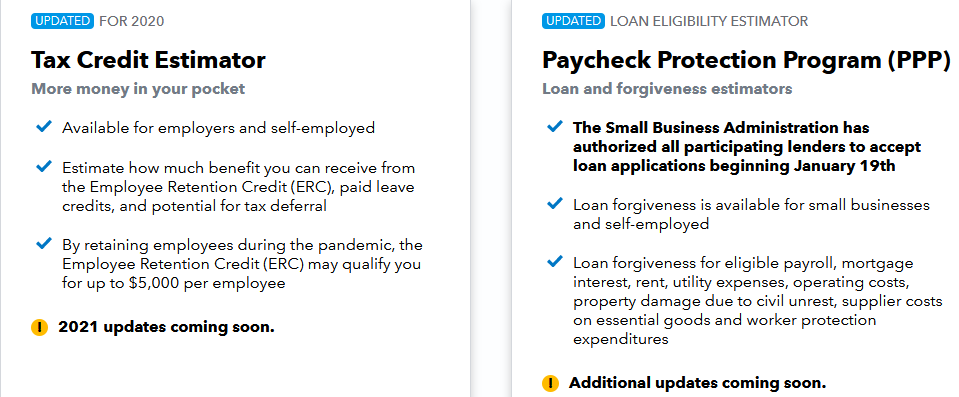

Free Website Helps Self Employed And Small Businesses Determine Ppp And Other Relief Options

Stimulus 2021 Self Employed Tax Credits And Social Security Tax Deferrals Available During Covid 19 Turbotax Tax Tips Videos

Solo 401k Contribution Limits And Types

Taxact Vs Turbotax Vs Taxslayer 2022 Comparison Which Is Best

![]()

Self Employment Tax Deductions Optimize Your Tax Return

Employee Social Security Tax Deferral Repayment Process

How To Repay Deferred Social Security Taxes For Self Employed Individual